[ad_1]

alvarez/E+ via Getty Visuals

The S&P World-wide Sector PMI™ uncovered that Cars & Vehicle Components sector output contracted throughout the world for a 2nd successive month amid the sharpest reduction in new orders considering that the COVID-19 pandemic and renewed supply disruptions joined to the pandemic and Russia-Ukraine war. There had been combined trends by areas, Europe and Asia ended up the hardest hit, with the latter looking at output falling at a sharper charge in Could. That explained, a crucial part of vehicles production – semiconductors – ongoing to see its brief source condition show indicators of easing in Might, according to PMI facts, which could bode effectively for the wider autos sector going ahead.

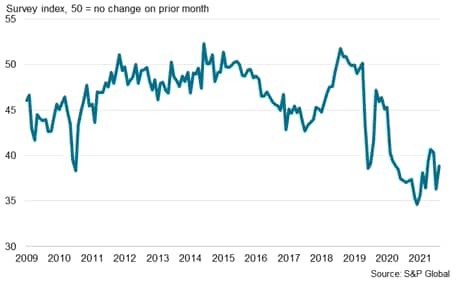

International Sector PMI displays vehicle sector output in contraction in May

The S&P World-wide Sector PMI™ indices are compiled from responses to questionnaires despatched to buying supervisors in S&P Global’s PMI study panels, masking about 27,000 personal sector companies in extra than 40 countries. The Sector PMI tracks 8 broad sectors – Essential Components, Consumer Products, Buyer Services, Financials, Healthcare, Industrials, Technological innovation and Telecommunication Providers – and 21 sub-sectors on a monthly foundation.

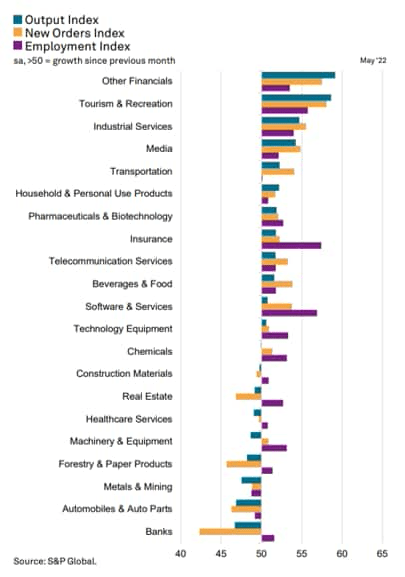

The hottest May survey signalled that while most types noticed organization exercise strengthen in May perhaps, a variety of sectors remained less than force amid weak need, supply shortages and steep rates. A lot of of these sectors had been concentrated in the manufacturing sector, with the likes of the Car & Auto Components sector ranking amongst the worst performers. May possibly also marked the next consecutive month in which the Cars & Car Areas sector noticed output slide, dragging the headline PMI for the sector into contraction territory for the initial time considering that July 2020.

Asia car sector output declines at a a lot quicker level in Might

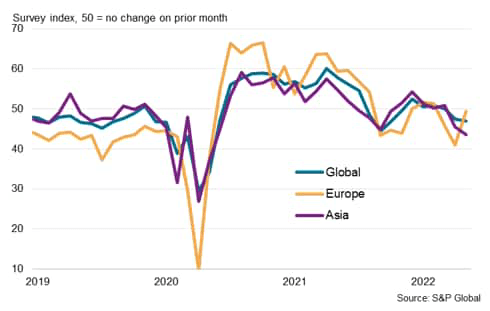

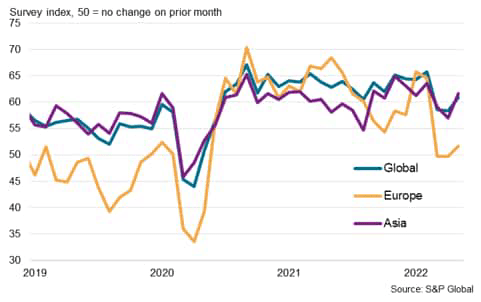

The price at which the World-wide Auto & Vehicle Parts sector declined was the quickest due to the fact October 2021. Mixed developments were noticed throughout the continents tracked with the contraction of Europe Automobile & Automobile Sections sector output easing markedly whilst Asia’s Automobiles & Car Parts output contraction accelerated to the quickest rate considering the fact that first months of the COVID-19 pandemic. The sector was also the worst accomplishing in the Asia area in Might.

Car & Vehicle Elements sector PMI output

A difficult source chain situation ongoing to plague the automobile sector in Could, with Increased China and encompassing areas, like Japan and Korea, continuing to see manufacturing impacted by COVID-19 lockdowns even though the Russia-Ukraine conflict also played a portion (See ” Might 2022 generation forecast sees variants from location to region“, 16 Could 2022). As this sort of, it perhaps minimal surprise to find Asia’s output getting the one particular to pose a drag on the total world-wide image.

World-wide buyer goods demand waver as investing change in direction of solutions

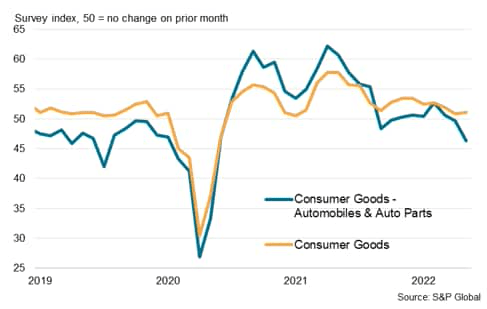

Main to the very poor Vehicles & Vehicle Areas sector output effectiveness had also been the weakness in need recorded in Could. Cars & Automobile Areas new orders fell at the swiftest charge since May perhaps 2020, which was at the heights of when the COVID-19 pandemic to start with broke out.

This was established in opposition to a backdrop whereby total Global Customer Goods new orders progress had been tapering into 2022 with supply chain difficulties, growing fees and a change in shelling out in the direction of companies underpinning the craze.

Purchaser Merchandise PMI new orders indices

Automotive sector source issues go on to outweigh need drop

Even with a deterioration in demand ailments for automobiles, and correspondingly automobile parts, it will have to be highlighted that backlogged perform ongoing to create in the World wide Vehicles & Auto Components sector midway into the second quarter. The PMI’s Backlogs of Work Index has now indicated a fourth successive month in which get the job done excellent rose, overlapping the two-thirty day period contraction of new orders. In fact, the rate at which backlogged function gathered accelerated in May well even as new orders fell sharply, indicating additional severe offer aspect bottlenecks.

World Car & Vehicle Elements sector PMI backlogs

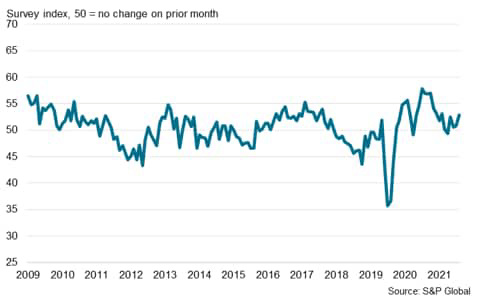

Evaluating the Suppliers’ Delivery Times index, vendor efficiency continued to deteriorate inside the Worldwide Cars & Car Parts sector. Even even though the level at which direct moments lengthened declined from April, it remained indicative of prevalent delays when as opposed to the study background, and is nowhere in the vicinity of the fee when factors initial recovered from the COVID-19 pandemic strike in 2020.

World Auto & Automobile Sections sector PMI suppliers’ shipping and delivery occasions

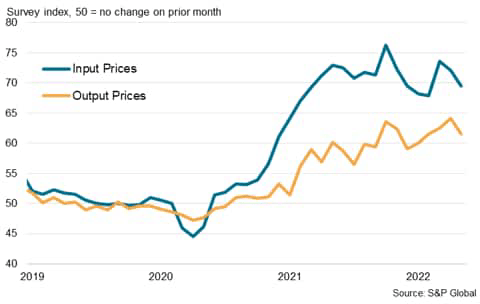

Car sector cost pressures simplicity marginally in Might

As a end result of the offer challenges on hand, price pressures also remained serious in Might. That mentioned, there had likewise been some early signs of easings throughout both of those input charges and output selling price inflation in Could in the Global Automobiles & Car Areas sector.

By geography, Europe’s Automobiles & Automobile Sections sector noticed both equally enter value and output value inflation decrease from the April history prices. Input charges however rose at the sharpest speed among the a variety of European business sectors tracked for a next thirty day period in a row. Around in Asia, selling price pressures also showed indications of easing with enter charges and output costs exhibiting significantly slower prices of growth in contrast to their western counterpart.

Auto & Vehicle Components sector PMI cost indices

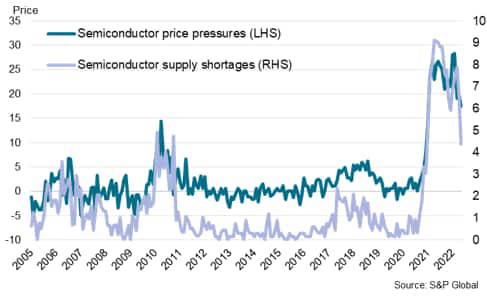

Semiconductor lack broadly display further signs of easing in May perhaps

Deep diving into the effectiveness of semiconductor offer and pricing condition, supplied the affect that this essential element has on automotive generation, we locate that semiconductor shortages confirmed even more signs of easing globally. This was according to our S&P Global PMI™ Commodity Price tag and Offer Indicators which track the advancement of value pressures and source shortages just about every month for at the very least 20 products utilizing responses collected from the S&P World wide Manufacturing PMI survey.

World-wide Commodity Value & Source Pressures: Semiconductors

Adhering to our update previous thirty day period wherever the Commodity Value and Offer Indicators signalled that the semiconductor shortage shown symptoms of peaking, the most recent May well facts experienced only further confirmed the trend, boding perfectly for the broader automotive sector.

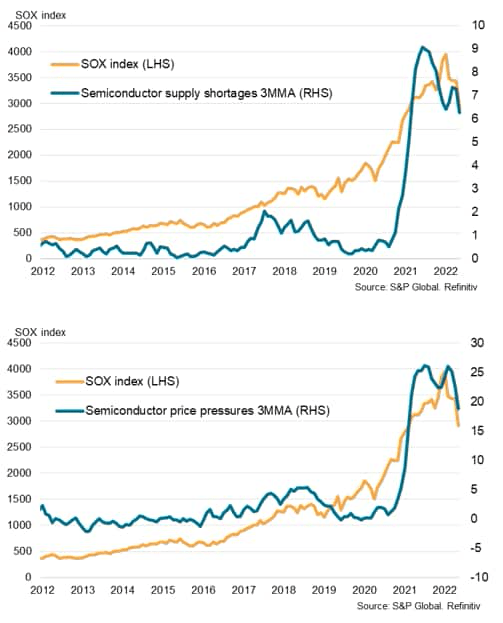

In transform for the Philadelphia semiconductor index (SOX index), which we come across the PMI gauges correlating with, there are indications that further SOX declines may well ensue. This was as the semiconductor price force and provide shortages indices both equally pulled decrease in May to the lowest readings given that early 2021.

International semiconductor offer shortages and selling price pressures vs. SOX index

Automotive sector outlook

Irrespective of the Worldwide Vehicles & Vehicle Components PMI slipping into contraction for the first time in just about two years, weighed by the sharpest new orders contraction considering the fact that the COVID-19 pandemic, sentiment enhanced globally among vehicle and auto areas makers in May possibly. This was also the scenario in both equally Europe and even Asia inspite of the onslaught of source woes gripping the sector.

Car & Car Sections sector PMI long term output

It is maybe with minor doubt that uncertainties persist the two on the demand from customers and provide facet amid a slowdown in international progress envisioned and with the Ukraine war and mainland China’s COVID-19 disruptions persisting. That claimed, the green shoots witnessed in this article from increasing company assurance among auto and car areas makers to easing semiconductor business constrains may supply some semblance of hope for advancements relocating ahead.

Editor’s Be aware: The summary bullets for this post have been picked out by In search of Alpha editors.

[ad_2]

Source url