[ad_1]

Automotive Every month E-newsletter &

Podcast:

What do capital marketplaces tell us about the automotive

business?

Despite the fact that money marketplaces grab headlines when dread

and volatility are greatest, the identical marketplaces do also purpose

rationally, and are a window into an ongoing re-analysis of

companies’ prospects and threats. So, what can we learn from the

point out of the marketplaces right now?

The autos sector consists of some of the most inexpensive and the most

expensive providers in the environment. This simultaneously displays both equally

the inherent troubles of legacy carmaking, and the markets’ hopes

for the long run beneficiaries of adjust. In latest months automotive

start ups have confronted a stark valuation actuality check, and the

virtual closure of the SPAC funding route displays far higher

scrutiny from traders. Additional money displacements are very likely

in the coming decades as a lumpy technological changeover plays out

all along the provide chain. None of this has basically transformed

the broad very long-phrase outlook for electrification. In the meantime close to

expression, there is lots of turbulence – notably from currency,

mainly to the detriment of US automakers.

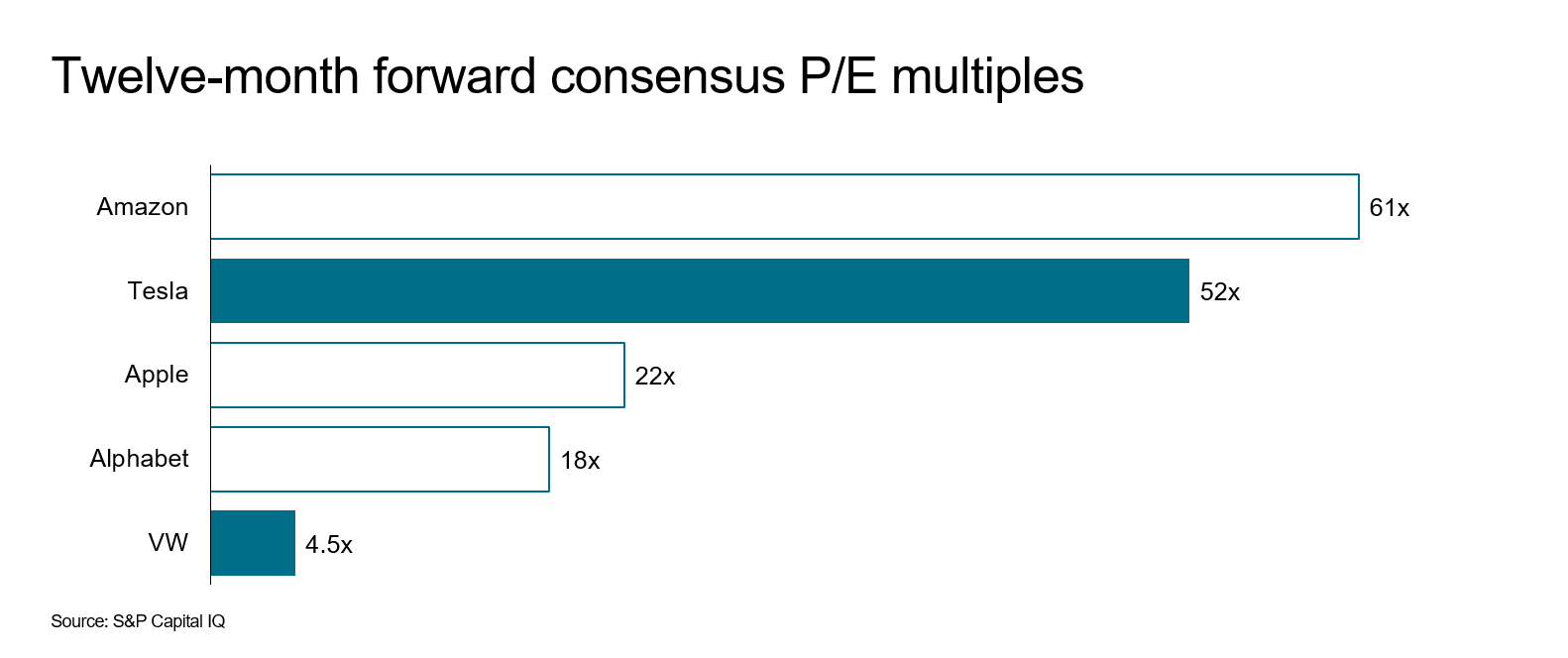

Autos is the most polarised sector

The automaking sector is in the abnormal position of that contains

the two some of the most economical – and some of the most highly-priced outlined

businesses in the planet. On a person side legacy founded automakers –

like VW trades at all over 4.5 moments its anticipated 2022 earnings. At

the other stop tech-concentrated electrical vehicle makers notably Tesla

for which this figure is 52 moments, (vs. for comparison Alphabet

18x, Apple 22x, and Amazon 61x) – plus many as still-unprofitable

begin-ups for which no these kinds of calculation is still possible.

Legacy autos’ valuations replicate inherent

challenges

Automakers like VW have traded inexpensively relative to their

earnings for a lot of decades. There are several motives why: Sector

profitability is reduced as opposed to its money necessities. Stability

sheet possibility is superior because of to inventory specifications and the require to

fork out (and also successfully underwrite) the hazards of component

suppliers and seller networks. This in switch means individual bankruptcy risk

in financial downturns is major. The new cohort of start-ups

claims to deal with quite a few of these: Reduce mechanical complexity

indicates lesser money prerequisites, and easier offer chains. A lot less

maintenance implies number of or no conventional dealers and lessen

inventories. For this group, becoming electric powered-only is the

enabler.

Relative development expectations underpin the valuation

hole

On the other hand, the clearest justification for the valuation gap is the

expansion differential. This yr-to-day, world-wide battery electric

auto gross sales grew 68% vs. prior yr, though overall mild vehicles

contracted by 13%. Legacy automakers accessibility to that development is

restricted because even BEV changeover leaders like BMW and VW have

close to 6% BEV in their revenue blend. Eventually, legacy automakers are

preventing to defend a $2.5tn industry, although new automakers aspire to

seize it – with very little to shed.

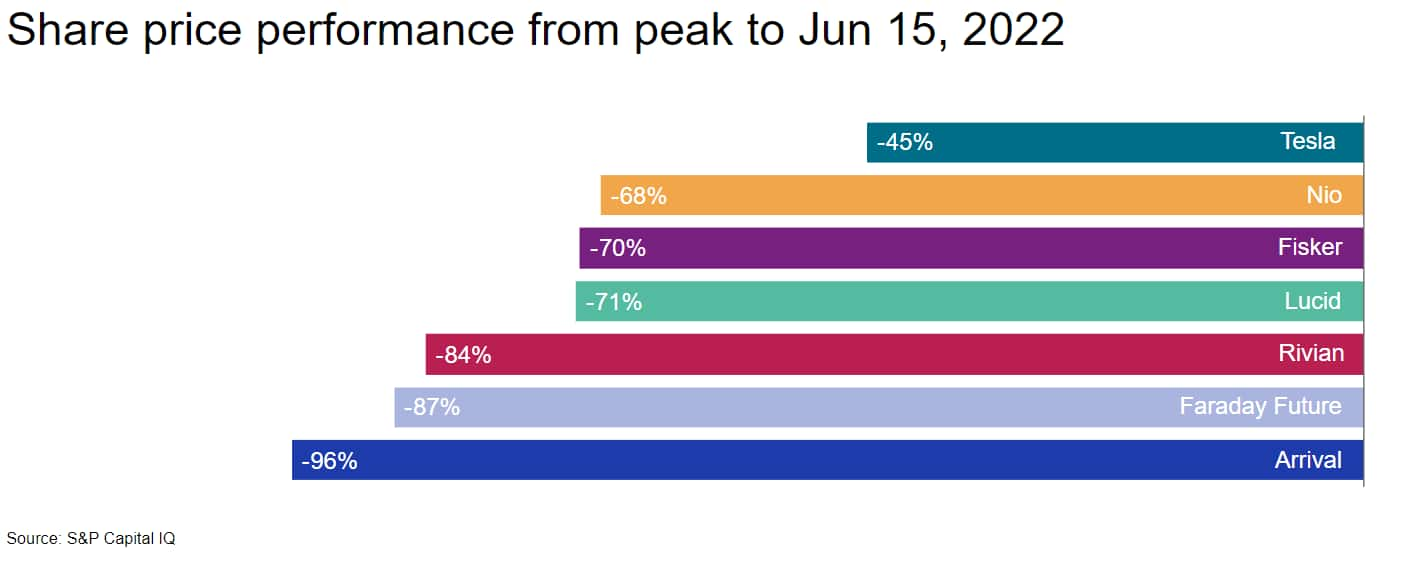

Investor urge for food for ‘New autos’ has waned

considerably

New automakers’ valuations have been through stark adjustments in

the past 12 months. The chart beneath lists a assortment of electric

carmakers and their recent market place values relative to their

respective peak degrees. These moves are partly macro-driven:

Economic problems have develop into far more challenging globally, with

advancement slowing, inflation up, and hunger for risky belongings in

basic significantly down. Nonetheless, the essential shift is probably

growing recognition of the troubles inherent in starting and

scaling automotive manufacturing from scratch.

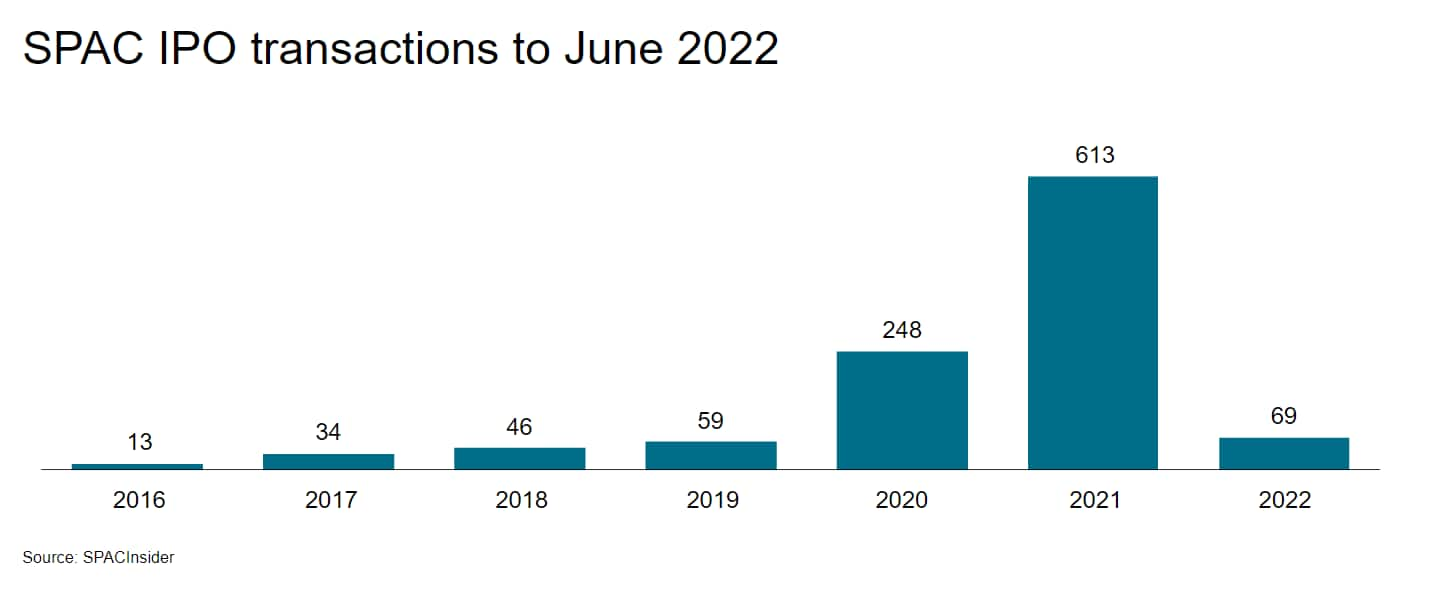

Chosen funding route now closed

At the exact time, the level of popularity of fundraising by means of the SPAC

(particular purpose acquisition company) route has ground to a virtual

halt, with 69 this kind of transactions in 2022 to day versus 613 all through

2021. EV businesses that went public by means of the speculative ‘blank

cheque’ technique in 2021 incorporated Fisker, Polestar, Lucid, and

Arrival. Providers now wishing to stick to in their footsteps are

likely to significantly bigger monetary scrutiny.

A bumpy transition

Early sector euphoria has not presented way to the actuality of the

undertaking in entrance of us. Unquestionably the advancement of BEVs and the

commensurate decline in ICEs (Inside Combustion Motor) will be

the industry’s most important changeover considering that its inception early

very last century – this will definitely not be easy. A transformation

which considerably impacts all aspects of the mobility ecosystem –

innovation, car progress, procedure sourcing, manufacturing

dynamics, retail engagement and the aftermarket – will be “bumpy”.

This will be uncharted territory at practically each individual degree.

Changeover velocity, motivation by stakeholders (individuals,

federal government, dealers etcetera.), securing upstream battery raw products,

altered logistic streams, client acceptance/education and an

all-new service dynamic all cloud the sky. The present-day ICE-focused

ecosystem took us above a century to hone – expecting a

transformation with minor drama by means of the upcoming decade is not

reasonable.

Funds displacement is probably across the

ecosystem

The prospect for cash displacement is superior at all ranges of

the ecosystem. Case in point are the component suppliers. Essential

to long term innovation, re-expense and most of the present-day vehicle

benefit increase, various suppliers in system parts which disappear in the

BEV world are faced with essential choices. The solutions are to stand

pat and experience the quantity decline, pivot, and target efforts on

units crucial to the BEV place, double-down and be a consolidator in

a declining industry, or merely promote the procedure. Timeframes will

vary however the displacement is undeniable. There will most

absolutely be winners and losers during the transition.

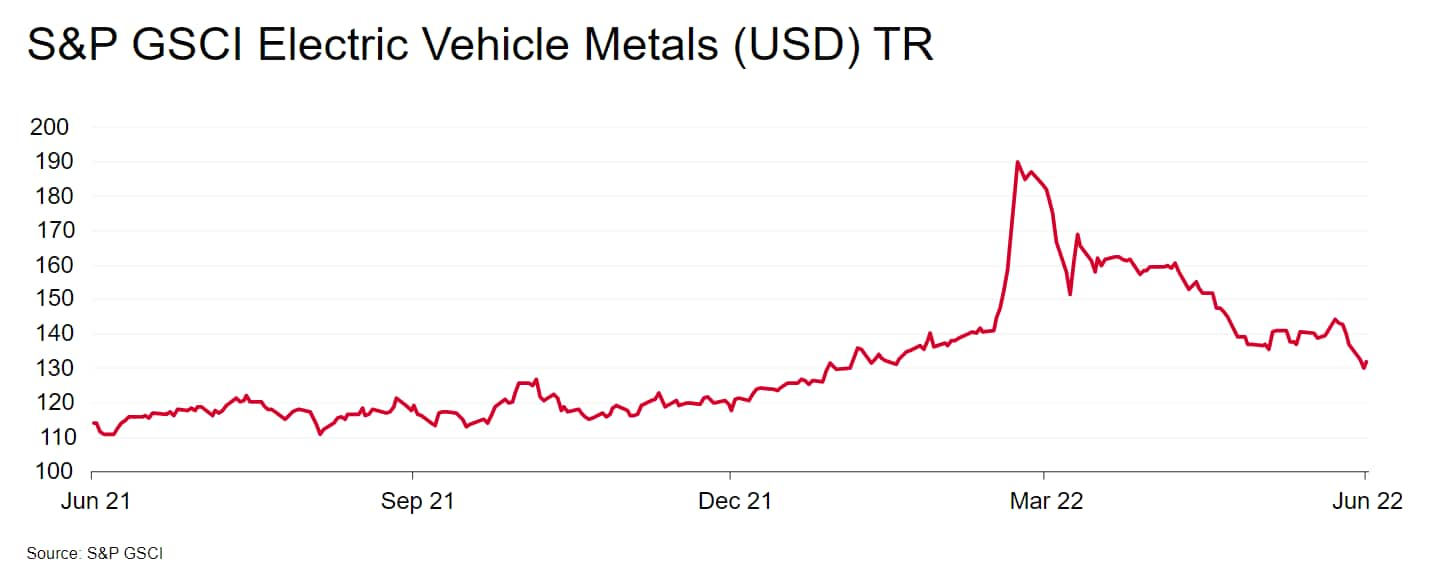

Electrification has not been derailed

Even with the ensuing ecosystems shifts, does this indicate

electrification now will not happen, or will happen slower? There is

limited proof of huge adjustments to the essential outlook. For

just one, the publish-Ukraine surge in battery raw product costs has

abated relatively, even though however-elevated gasoline selling prices deliver

assistance to BEV possession costs on a relative basis. On top of that,

regulatory momentum carries on to work in favour of electrification,

with the EU parliament notably voting in early June to ban new

inner combustion gross sales from 2035, albeit continue to topic to

settlement from notable opponents this sort of as Germany.

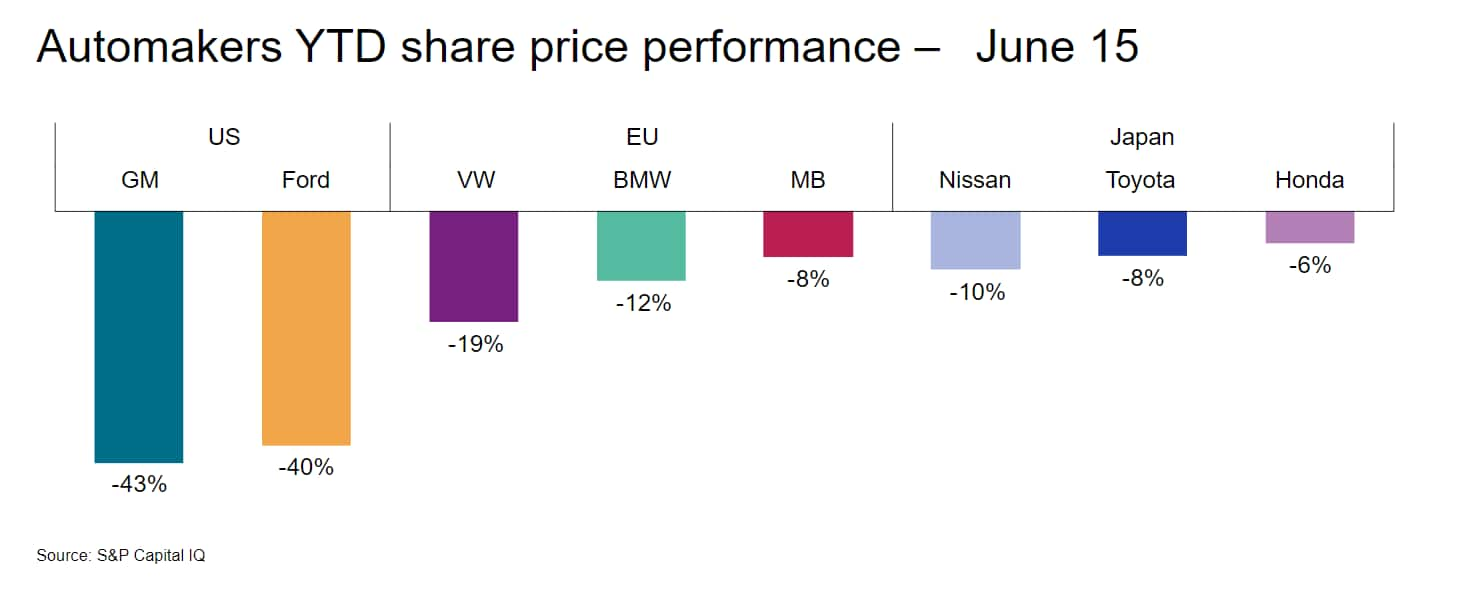

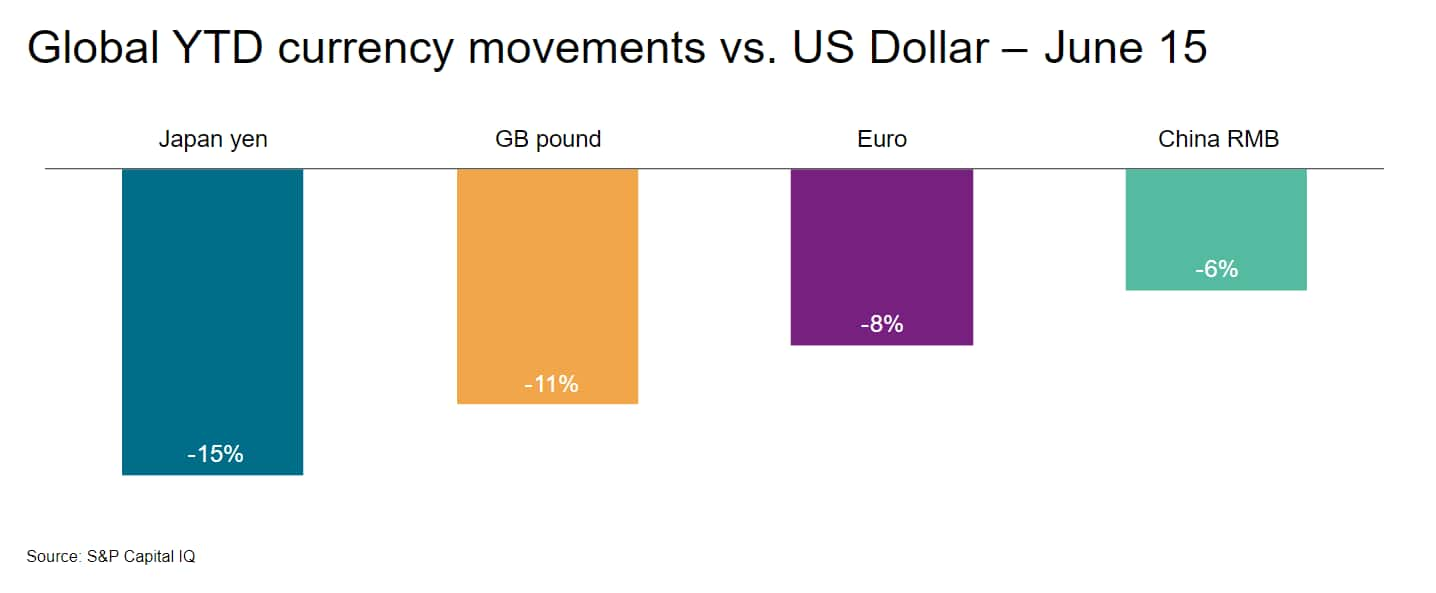

The shifting sands of currency

Ultimately, a notice on currency actions. International automakers’

fortunes are to some extent a operate of central banks’

most likely divergent approaches to tackling inflation in the

coming several years. Specially, a strong US greenback is creating

headaches for US domestic carmakers, and a increase to those people

somewhere else. The dollar’s 19 calendar year superior vs. other currencies (USDX

index) hurts GM and Ford because their income from abroad

functions is brought dwelling at a significantly less favourable trade amount.

Conversely, a solid greenback is good information for automakers outside the

United States, whose overseas gains are boosted by currency

results. No matter whether investing exterior the United States tends to make feeling

relies upon on one’s perspective: A US trader in Nissan would have

observed its shares slide only 10% but would have shed yet another 15% from

the weakening yen.

————————————————————————————————-

Dive Deeper:

Auto demand insights at your fingertips. Understand

a lot more.

S&P Global Mobility updates

light automobile manufacturing forecast for June. Read through the

post.

Request the

Expert: Demian Bouquets, Automotive Fiscal Analyst

Ask the Specialist: Michael Robinet,

Govt Director, Automotive Consulting Providers

This article was released by S&P International Mobility and not by S&P World Scores, which is a separately managed division of S&P Worldwide.

[ad_2]

Resource backlink